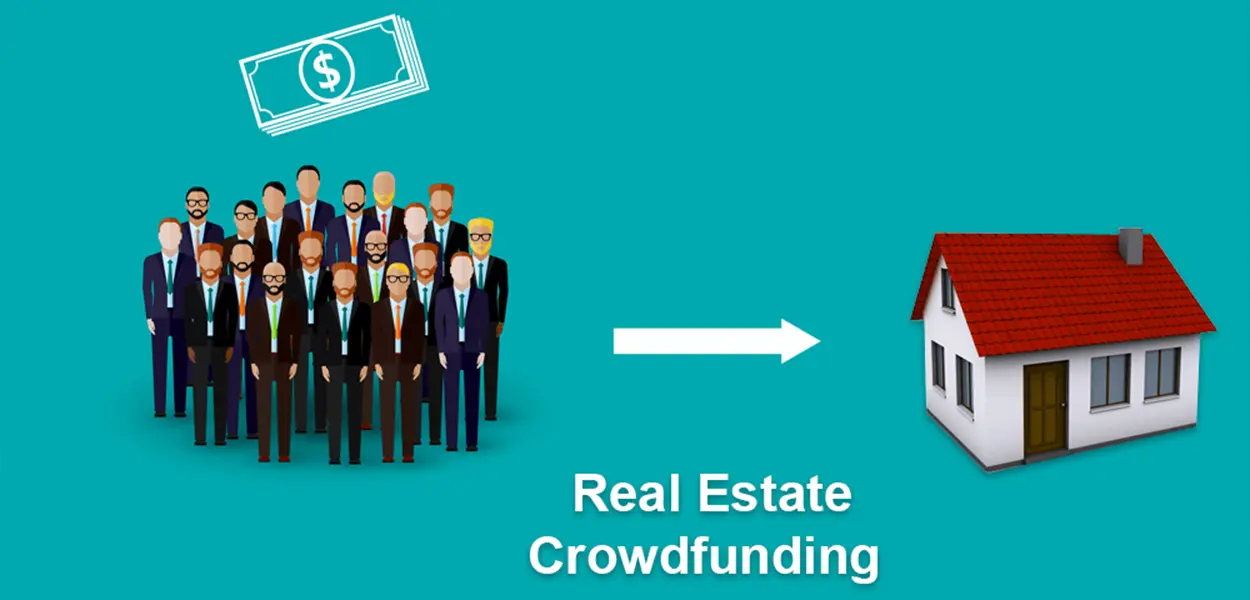

🏠 What is Real Estate Crowdfunding?

Real estate crowdfunding allows investors to pool their capital to invest in real estate projects. It democratizes access to real estate investments, previously available mostly to wealthy individuals or institutional investors. Platforms typically offer a range of property types, including residential, commercial, and mixed-use developments.

| Crowdfunding Type | Description |

|---|---|

| Equity Crowdfunding | Investors purchase shares in real estate properties, gaining ownership interest. |

| Debt Crowdfunding | Investors lend money to real estate developers and receive interest over time. |

By joining a crowdfunding platform, you can invest in real estate with as little as $500, significantly lowering the barriers to entry.

🏆 Top Real Estate Crowdfunding Platforms in the U.S. for 2025

Several platforms are leading the charge in providing diverse investment opportunities. Below are some of the top real estate crowdfunding platforms for 2025:

| Platform | Overview | Key Features |

|---|---|---|

| Fundrise | One of the largest platforms, offering both equity and debt investments. | Low minimum investments, diverse real estate options, automated investing. |

| CrowdStreet | Specializes in commercial real estate projects, targeting accredited investors. | Direct investment in institutional-grade properties, high returns potential. |

| RealtyMogul | Offers both equity and debt investments in residential and commercial properties. | Access to vetted real estate projects, easy-to-use platform. |

| PeerStreet | Focuses on debt investments, particularly real estate loans. | Targeted for passive income through interest payments, low minimums. |

| Groundfloor | Allows investors to fund residential real estate projects. | Focuses on short-term investments, low entry fees, real estate flip opportunities. |

These platforms cater to different types of investors, from beginners to seasoned professionals, and offer opportunities in various property sectors.

💸 How Real Estate Crowdfunding Works

The process of investing in real estate crowdfunding typically follows these steps:

| Step | Description |

|---|---|

| Step 1: Registration | Sign up on the platform, create an account, and verify your identity. |

| Step 2: Browse Projects | Review available investment opportunities, including project details, projected returns, and risks. |

| Step 3: Make Investments | Choose a project, select your investment amount, and complete the transaction. |

| Step 4: Monitor Performance | Track your investment's performance and receive dividends or interest payments over time. |

This process makes it easy to participate in real estate investing without owning the properties directly.

🔑 Benefits of Real Estate Crowdfunding

Real estate crowdfunding offers several advantages to investors:

| Benefit | Explanation |

|---|---|

| Diversification | Allows investors to diversify their portfolios by investing in multiple properties with different risk levels. |

| Access to Large Projects | Provides access to commercial properties and large-scale developments that may be otherwise out of reach. |

| Passive Income | Many platforms offer dividends or interest payments, providing a steady stream of passive income. |

| Low Minimum Investments | Start investing with as little as $500, making it more accessible to everyday investors. |

These benefits make real estate crowdfunding a compelling option for individuals looking to invest in real estate without the complexities of property management.

⚠️ Risks of Real Estate Crowdfunding

While real estate crowdfunding can offer substantial returns, it is not without risks:

| Risk | Explanation |

|---|---|

| Illiquidity | Investments are typically illiquid, meaning you can't easily sell or withdraw your investment. |

| Market Risk | The real estate market can be volatile, and changes in the market can affect your investment's performance. |

| Platform Risk | The success of your investment is dependent on the crowdfunding platform’s management and operations. |

It's important to weigh these risks carefully and ensure that you are comfortable with the investment's long-term nature.

🏁 Conclusion

Real estate crowdfunding has opened the door for many people to invest in real estate projects that were once reserved for large institutions or wealthy individuals. With platforms like Fundrise, CrowdStreet, and RealtyMogul, you can start investing in real estate with minimal capital, while benefiting from diversification and passive income. However, it's essential to understand the risks involved and make informed decisions when choosing a platform and project to invest in.